What is a pre-existing condition?

A pre-existing condition is any injury or illness that your pet shows symptoms of before the start of your first policy and applicable waiting periods and is excluded from coverage.

This means symptoms or signs that you or your vet could observe or have found during testing or examinations. Occurring before you start a policy or have finished applicable waiting periods, whether the condition has been diagnosed or not.

To help sick pets get better, we at Trupanion just look for any condition that presented before signing up or during the waiting periods (5 days for injuries, 30 days for illnesses) to determine what is a pre-existing condition and not eligible for cover. Please view our policy wording for all the details.

To illustrate how pre-existing conditions are considered;

Let’s say your pet displays a typical sign of ‘limping’ pre-policy commencement. You visit your local veterinarian and your pet is diagnosed and successfully treated for a pulled toe nail.

Other medically unrelated conditions that may also present with the typical sign of ‘limping’, include:

• Tendonitis,

• Osteoarthritis,

• Infection of the joints, muscles or tendons,

• Trauma causing broken bones,

• Osteosarcoma (bone cancer).

Trupanion, as part of the claims handling process, will assess whether the pre-policy ‘typical signs’ are Medically Related to the claimed condition. In this example, a pulled toe nail that presented with the typical sign of limping is not Medically Related to any subsequent ‘post-policy’ claims for tendonitis, osteosarcoma or any other condition listed above, and as such these conditions would be covered if they presented ‘post-policy’ commencement (following waiting periods).

Medically Related means signs or evidence that are reasonably connected based on well-recognised current veterinary knowledge and practice.

Please view our policy wording for all the details, we’ve gone to the trouble of adding examples in our policy to aid your understanding.

Avoiding pre-existing conditions

The best way to avoid facing issues with pre-existing conditions is to sign your pet up while they are young and healthy. The sooner they sign up, the more likely it is that any future injuries and illnesses are covered by the policy.

Examples:

Before you sign your dog up, they’re constantly licking their paws.

After you sign them up, they’re diagnosed with allergies. Are their allergies eligible for cover?

No, the allergies are considered pre-existing and are not covered. The incessant licking before their cover began was a symptom of your dog’s allergies.

Veterinary terms for allergies include atopy, allergic dermatitis, contact dermatitis

You enroll your cat who develops a sarcoma mass on their back during the policy waiting period.

Is their sarcoma eligible for cover?

No, the sarcoma is considered pre-existing and is not covered. That mass and any future sarcomas are considered pre-existing because it developed during the waiting period.

Before you signed up, your dog sprained their knee. After you sign up, they developed hip dysplasia.

Is their hip dysplasia eligible for cover?

Yes, the hip dysplasia is covered. The knee injury and the hip dysplasia are not medically connected, so would not be considered pre-existing.

Your cat has a history of urinary tract infections before starting your policy

Would future claims for urinary tract infections be covered?

No, claims for treatment for urinary tract infection would not be covered as it is highly likely to have another urinary tract infection in future. This would be a pre-existing condition.

Your dog has entropion (rolled in eyelid) on its left eye before your enrolled (started a policy)

Would the right eye be covered if it also developed entropion later on after you started a policy?

No. Entropion is a condition that if it occurs on one side of the body (left and right) is a key risk to happening on the other side also. This bilateral condition (on either side of the body) is excluded if it occurs before the policy starts. Other common conditions that occur on both sides relate to eyes, ears, hip joints, knee and elbows.

PLEASE NOTE: These are meant only as examples. Actual eligibility for any condition cannot be determined until a claim is submitted.

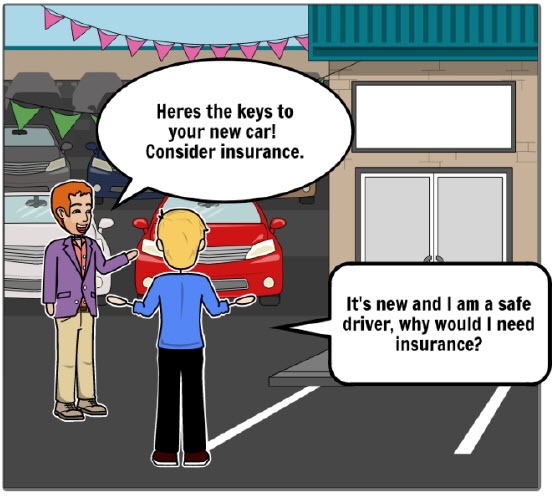

Think about it this way:

You wouldn’t buy car insurance after you got into a wreck and expect insurance to help cover the cost of the accident. Pet insurance works on the same principle; it cannot protect you from something that already happened or is in the process of happening.

Should I still sign up if my pet has pre-existing conditions?

Even if your pet has a pre-existing condition or shows symptoms of a condition that is medically connected to a condition that presents after you sign up, they are still eligible for cover for any new injuries and illnesses.

Often, older pets sign up with symptoms of a pre-existing condition that would not be covered. However, the older a pet gets, the more likely they are to develop new issues that could still be covered. If your pet has had multiple illnesses in their lifetime, it may be harder for any new issues to be eligible for cover and it’s recommended you begin saving to help with any future health expenses that an insurance policy can’t cover.

Every pet’s situation is unique, so we recommend calling our pet-loving Customer Care team at 1300 328 042 to chat about how pre-existing conditions could affect your policy.

Why does Trupanion exclude pre-existing conditions?

Trupanion is here to help responsible pet owners budget for unexpected illnesses and injuries throughout their pet’s life. If a condition has occurred before insurance is started, it no longer becomes about the unexpected, as it is more likely that the pet will have that condition again in future. It becomes predictable. We encourage you to check out our pricing promise for more information about how Trupanion prices the insurance differently to other insurers to be fairer over the whole pet’s life.

What if Trupanion didn’t exclude pre-existing conditions?

People would take out insurance after a pet is sick or injured. Defeats the purpose of insurance right?

The reality is that you (or anyone) doesn’t know if a pet will be lucky or unlucky in its lifetime. Pre-existing exclusions are there to prevent people from taking out insurance after the animal is sick or injured, insurance is there to help those “unlucky” few pets to be covered by the lucky many, the cost and risk shared across a larger group. We believe that is how insurance works best.

Our expertise is knowing the average pets cost of veterinary care across an entire lifetime through covering 1 million pets globally and paying out over $2,700,000,000 USD globally in claims. We can offer a unique value to members by having truly broad coverage for unexpected conditions, and by not paying for conditions that are expected.

As a member the key takeaway is that it would be unfair to you to ask you to pay a premium to cover other people’s predictable veterinary cost!